Sam Richards of the Contra Costa Times shares with us a fun little event “Have coffee Friday with Lafayette’s mayor.” Lafayette residents and anyone who would like to learn about what is going on in the city of Lafayette are invited to attend this meeting with Mayor Carl Anduri. It is scheduled to begin 8:00 am in the conference room of the Lafayette Chamber of Commerce office, 100 Lafayette Circle No. 103.

Posted in Lafayette, Upcoming Events | Tagged California, callahan, carl anduri, coffee, contra costa times, events, lafayette, mcdaniel, neighbors, news, northern california, real estate, sam richards, team | Leave a Comment »

Bay Area median sale price tops year-ago level for first time since ‘07

November 19, 2009

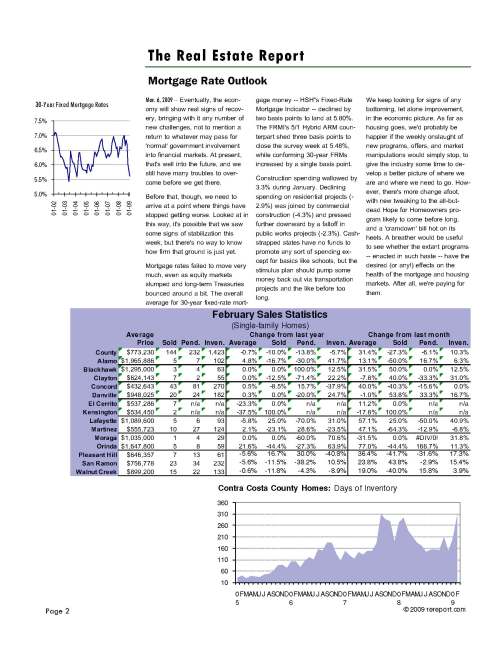

La Jolla, CA.—-The Bay Area’s housing market continued to ease back toward normalcy last month as fewer distressed properties sold and $500,000-plus sales accounted for a greater share of transactions than a year ago. The result: The nine-county region posted a modest year-over-year gain in its median sale price – the first in nearly two years, a real estate information service reported.

The median price paid for all new and resale houses and condos that closed escrow rose to $390,000, up 6.8 percent from $365,000 in September and up 4 percent from $375,000 in October 2008. The last time the median sale price rose on a year-over-year basis was in November 2007, when it gained 1.5 percent, according to MDA DataQuick of San Diego.

Last month’s median was the highest since it was $395,000 in July this year, but it was 41.4 percent below the $665,000 peak reached in June and July of 2007.

“The regional price statistics mainly reflect the fading of the foreclosures and the uptick in high-end activity in recent months,” said John Walsh, MDA DataQuick president. “Down at the neighborhood level, different things are happening depending on location, but the big picture is that prices in many areas appear to be bouncing along bottom. Whether that bottom is permanent is the subject of endless debate right now.”

In addition to the Bay Area overall, three counties – Santa Clara, Marin and Sonoma – saw their median sale prices rise year-over-year last month. The last time that more than one county posted an annual gain in the median was November 2007. Also last month, Alameda, Santa Clara, San Francisco and the nine-county region overall posted single-digit annual gains in their median price paid for a specific home-type: resale single-family detached houses.

A total of 7,933 new and resale houses and condos closed escrow in the nine-county Bay Area last month. That was up 0.7 percent from 7,879 in September and up 4.2 percent from 7,613 in October 2008.

Last month’s sales were 10.2 percent below the October sales average of 8,833 since 1988, when DataQuick’s stats begin. October sales have ranged from a low of 5,486 in 2007 to a high of 13,392 in 2003. The average change in sales between September and October since 1988 is a gain of 0.9 percent.

Sales in the region’s higher-cost counties – Marin, San Francisco, Santa Clara and San Mateo – represented 42.2 percent of October sales, up from 35.3 percent a year ago, when more sales were concentrated in the lower-cost inland areas rife with deeply discounted foreclosures. Sales over $500,000 made up 36 percent of all sales last month, up from 34.9 percent a year ago and a low this year of 22.7 percent in January.

October’s overall increase in sales from September and a year ago came even as fewer foreclosed properties sold. Foreclosure resales – homes sold in October that had been foreclosed on in the prior 12 months – made up 31.9 percent of all resale activity. That was down from 32.3 percent the prior month and 44.0 percent in October 2008. It was the lowest since foreclosure resales were 29.9 percent of all resales in June 2008. Foreclosure resales peaked at 52 percent of Bay Area resales in February this year.

Between January 2000 and December 2007, foreclosure resales averaged only about 1 percent of all Bay Area resales each month. Since January 2008, the monthly average for foreclosure resales is about 37 percent.

The recent decline in foreclosure resales follows a generally downward trend this year in the number of homes being foreclosed on. It’s mainly because lenders and loan servicers have increasingly pursued short sales and loan modifications as an alternative to the costly foreclosure process. The declining inventory of lower-cost foreclosures has been key to stabilizing the housing market, along with the federal government’s efforts to boost housing demand through lower mortgage rates, tax incentives and plentiful, low-down-payment FHA financing.

Federally-insured FHA loans, a popular choice among first-time buyers, made up 25.9 percent of all Bay Area purchase loans last month. That was up from 24.9 percent in September, 19 percent a year ago and less than 1 percent two years ago.

Meanwhile, the availability of financing for pricier homes continued to show mild signs of improvement, but such “jumbo” loans remained relatively expensive and difficult to obtain.

Mortgages above $417,000 – formerly the definition of a jumbo loan – made up 30.1 percent of all home purchase loans last month. That was up from 29.6 percent in September and 25.9 percent a year ago. More than 60 percent of Bay Area purchase loans were over $417,000 before the August 2007 credit crunch hit.

Another fuel source for high-end sales – adjustable-rate mortgages (ARMs) – continues to be used far less than what’s been normal historically, but has trended higher lately. In October, 8.1 percent of Bay Area purchase loans were ARMs, up from 7.9 in September and 7.4 percent a year earlier. ARMs fell to a record low of 3.0 percent in January this year. ARMs had averaged 61 percent of the region’s purchase loans this decade up until the August 2007 credit crunch.

San Diego-based MDA DataQuick is a division of MDA Lending Solutions, a subsidiary of Vancouver-based MacDonald Dettwiler and Associates. MDA DataQuick monitors real estate activity nationwide and provides information to consumers, educational institutions, public agencies, lending institutions, title companies and industry analysts. Because of late data availability, sales were estimated in Alameda and San Mateo counties.

The typical monthly mortgage payment that Bay Area buyers committed themselves to paying was $1,665 last month, up from $1,578 the previous month, and down from $1,837 a year ago. Adjusted for inflation, current payments are 36.7 percent below typical payments in the spring of 1989, the peak of the prior real estate cycle. They are 53.3 percent below the current cycle’s peak in July 2007.

Indicators of market distress continue to move in different directions. Foreclosure activity is off its recent peak but remains high by historical standards, with mortgage default notices flattening out or trending lower in some areas but edging higher in others. Financing with multiple mortgages is low, down payment sizes are stable, and non-owner occupied buying is above-average in some markets, MDA DataQuick reported.

| Sales Volume | Median Price | |||||

| All homes | Oct-08 | Oct-09 | %Chng | Oct-08 | Oct-09 | %Chng |

| Alameda | 1,544 | 1,555 | 0.7% | $369,500 | $369,000 | -0.1% |

| Contra Costa | 1,888 | 1,679 | -11.1% | $285,000 | $280,000 | -1.8% |

| Marin | 220 | 264 | 20.0% | $599,750 | $648,000 | 8.0% |

| Napa | 135 | 121 | -10.4% | $400,000 | $360,000 | -10.0% |

| Santa Clara | 1,520 | 1,944 | 27.9% | $477,000 | $500,000 | 4.8% |

| San Francisco | 414 | 553 | 33.6% | $699,000 | $690,824 | -1.2% |

| San Mateo | 530 | 586 | 10.6% | $605,000 | $580,000 | -4.1% |

| Solano | 745 | 681 | -8.6% | $240,000 | $195,000 | -18.8% |

| Sonoma | 617 | 550 | -10.9% | $330,000 | $331,000 | 0.3% |

| Bay Area | 7,613 | 7,933 | 4.2% | $375,000 | $390,000 | 4.0% |

Source: MDA DataQuick Information Systems, http://www.DQNews.com

Go to Data Quick for additional reports

Posted in 1 | Leave a Comment »

Posted in Alamo Real Estate | Tagged alamo, California, market, real estate, update | Leave a Comment »

It’s 2:03… very quick motions… quake…very strong sudden moves….

Posted in 1 | Leave a Comment »

Shortly before 2:00 am, 6/6/08 we had a very nice rumble……this really moved the house quickly…Terry

Posted in 1 | 2 Comments »

Yes… we will never have a disaster…. Well, maybe never… But, if it happens and it may, I would you rather be prepared not hopelessly naked… I mean naked…Not being prepared for what you and your family must and will endure is just not acceptable…. Yes, McDonalds will not be open, nor will your telephone, water or computer, gas, or electricity……… I choose to be Prepared. I like to eat three meals a day……..

So, Sally our neighbors to hear Herbert Cole, Cert Area leader and Ray Bryant about the local CERT program……. Wow…. water and food we have……. but we’re a little short on other thisngs…. Like having a USB stick… filled with important documents. Put your most valuable record on your stick. Your pictures, inventory of your home, picture of your valuables, insurance papers, poster of missing person like you or your spouse, kids and family… Relief workers will have computers, so you will be able stick your USB thumb drive into their computers and immediate get relief….. and you will have a resource of information to expedite either the search or recover………Email me….Terry@terrymcdaniel.com and I will send you a list of resources, plus direct your to the CERT info….. Be the Hero… then go and do…Terry

Posted in CERT, Upcoming Events | Tagged CERT, diaster, electricity, heighbors, it happens, prayer, relief worker, resources, spouse, usb | Leave a Comment »

It’s time for us to really consider Incorporation. If you missed the big fund raising event a Roundhill, you missed a good time……. $60k raised to help pay for the incorporation study….But we’ll need $200k to complete the feasibility study and other required studies for LAFCO….If you live in Alamo, you future will be effected by this decision….Get involved…. Let’s talk about… Right now we need to raise more money….. Questions… contact Claudia Waldron….. or visit… AlamoCommunity

Posted in Upcoming Events | Tagged alamo, Claudia, incorporation...., LAFCO, raise money | Leave a Comment »

Real Estate values nationally are dropping to stable, but not everywhere….USA average appreciat 1.9%…. California not so good… Head to Texas 6.8% growth…. Well, pack the bags and head to Alamo, Texas.. oops….Not…. Alamo, California…. where life is good and you don’t have to change your shirt twice daily……

TOP HOUSE APPRECIATION RATES IN PAST YEAR

Source: Office of Federal Housing Enterprise Oversight

Posted in Upcoming Events | Tagged alamo, appreciation, California, Elvis, housing prices, real estate, Texas | Leave a Comment »